Featured

Table of Contents

- – What is included in Level Term Life Insurance ...

- – Why do I need Level Term Life Insurance Premiums?

- – What is the difference between Level Term Lif...

- – How do I get Level Term Life Insurance Benefits?

- – Who are the cheapest Affordable Level Term L...

- – Who offers Level Term Life Insurance For You...

Premiums are normally lower than entire life plans. With a degree term plan, you can choose your protection quantity and the plan size.

And you can not cash out your plan throughout its term, so you will not receive any kind of economic benefit from your previous coverage. Similar to other kinds of life insurance policy, the price of a degree term plan depends upon your age, insurance coverage needs, work, way of life and wellness. Commonly, you'll find much more affordable insurance coverage if you're more youthful, healthier and much less risky to insure.

Considering that degree term costs stay the exact same throughout of coverage, you'll understand specifically how much you'll pay each time. That can be a huge help when budgeting your expenditures. Degree term protection also has some adaptability, permitting you to personalize your policy with extra features. These frequently come in the type of cyclists.

You might have to fulfill details conditions and certifications for your insurance provider to establish this biker. There also can be an age or time restriction on the protection.

What is included in Level Term Life Insurance coverage?

The survivor benefit is generally smaller sized, and protection normally lasts until your kid transforms 18 or 25. This rider might be a much more cost-efficient means to aid guarantee your kids are covered as cyclists can commonly cover multiple dependents at the same time. When your kid ages out of this protection, it might be possible to transform the motorcyclist into a brand-new policy.

The most common type of irreversible life insurance is whole life insurance policy, but it has some essential differences compared to degree term coverage. Right here's a basic overview of what to take into consideration when comparing term vs.

Whole life insurance lasts for life, while term coverage lasts for a specific periodParticular The premiums for term life insurance coverage are normally lower than entire life insurance coverage.

Why do I need Level Term Life Insurance Premiums?

Among the major attributes of level term coverage is that your premiums and your survivor benefit don't change. With decreasing term life insurance policy, your costs stay the very same; nevertheless, the fatality advantage quantity gets smaller in time. For example, you may have protection that starts with a death advantage of $10,000, which could cover a home loan, and afterwards every year, the survivor benefit will decrease by a set amount or percent.

Due to this, it's usually an extra cost effective sort of degree term coverage. You may have life insurance policy through your employer, however it may not suffice life insurance policy for your requirements. The initial step when acquiring a plan is identifying just how much life insurance policy you require. Take into consideration elements such as: Age Family members dimension and ages Employment standing Income Debt Way of living Expected last costs A life insurance policy calculator can aid determine how much you require to start.

After picking a plan, finish the application. For the underwriting procedure, you might need to provide general personal, health, lifestyle and work details. Your insurer will certainly identify if you are insurable and the threat you might offer to them, which is mirrored in your premium costs. If you're authorized, sign the paperwork and pay your first costs.

Finally, take into consideration organizing time every year to examine your plan. You might intend to upgrade your beneficiary info if you have actually had any type of considerable life modifications, such as a marriage, birth or divorce. Life insurance policy can often really feel difficult. You do not have to go it alone. As you discover your options, think about discussing your needs, wants and worries about a financial expert.

What is the difference between Level Term Life Insurance Policy Options and other options?

No, level term life insurance doesn't have cash worth. Some life insurance policy policies have an investment feature that enables you to construct money worth in time. Level term life insurance. A portion of your costs payments is alloted and can earn interest with time, which expands tax-deferred during the life of your insurance coverage

These policies are frequently significantly more costly than term coverage. If you get to the end of your plan and are still active, the protection finishes. However, you have some options if you still want some life insurance protection. You can: If you're 65 and your insurance coverage has gone out, for example, you may wish to buy a brand-new 10-year level term life insurance coverage policy.

How do I get Level Term Life Insurance Benefits?

You may be able to convert your term coverage right into a whole life policy that will certainly last for the remainder of your life. Many types of level term plans are convertible. That implies, at the end of your protection, you can transform some or every one of your plan to entire life protection.

Degree term life insurance policy is a plan that lasts a set term generally in between 10 and three decades and comes with a level fatality advantage and level premiums that stay the same for the whole time the policy holds. This means you'll know exactly just how much your repayments are and when you'll need to make them, enabling you to budget plan appropriately.

Level term can be an excellent alternative if you're looking to acquire life insurance policy protection for the very first time. According to LIMRA's 2023 Insurance coverage Measure Research Study, 30% of all adults in the U.S. need life insurance policy and do not have any kind of plan yet. Level term life is predictable and inexpensive, that makes it among the most popular kinds of life insurance

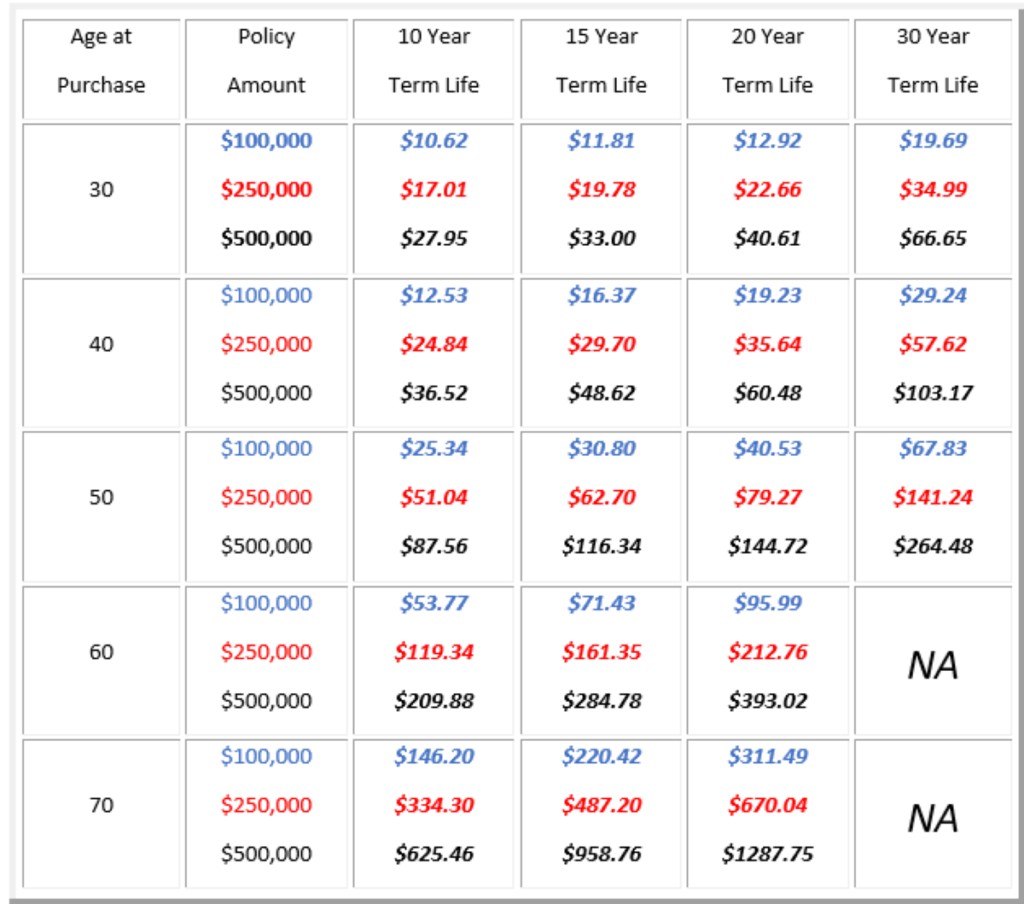

A 30-year-old man with a similar account can anticipate to pay $29 monthly for the same protection. AgeGender$250,000 protection quantity$500,000 protection amount$1 million insurance coverage amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Method: Typical monthly prices are determined for male and women non-smokers in a Preferred wellness category getting a 20-year $250,000, $500,000, or $1,000,000 term life insurance coverage policy.

Who are the cheapest Affordable Level Term Life Insurance providers?

Prices may differ by insurer, term, protection amount, wellness course, and state. Not all plans are available in all states. Rate picture legitimate since 09/01/2024. It's the cheapest kind of life insurance policy for most individuals. Degree term life is a lot more budget friendly than a similar entire life insurance policy plan. It's very easy to handle.

It enables you to budget plan and plan for the future. You can quickly factor your life insurance policy into your spending plan since the costs never change. You can intend for the future equally as conveniently since you know exactly how much money your liked ones will receive in case of your absence.

Who offers Level Term Life Insurance For Young Adults?

This holds true for people who stopped smoking or that have a health and wellness condition that settles. In these situations, you'll normally have to go with a brand-new application procedure to obtain a far better price. If you still require coverage by the time your degree term life policy nears the expiration day, you have a few choices.

Table of Contents

- – What is included in Level Term Life Insurance ...

- – Why do I need Level Term Life Insurance Premiums?

- – What is the difference between Level Term Lif...

- – How do I get Level Term Life Insurance Benefits?

- – Who are the cheapest Affordable Level Term L...

- – Who offers Level Term Life Insurance For You...

Latest Posts

Insurance For Funeral Costs

Burial Expense

Does Health Insurance Cover Funeral Costs

More

Latest Posts

Insurance For Funeral Costs

Burial Expense

Does Health Insurance Cover Funeral Costs