Featured

Table of Contents

Insurer won't pay a minor. Rather, consider leaving the money to an estate or trust. For even more comprehensive details on life insurance policy obtain a copy of the NAIC Life Insurance Policy Customers Guide.

The IRS positions a limit on just how much cash can go into life insurance policy premiums for the plan and just how quickly such premiums can be paid in order for the policy to retain every one of its tax advantages. If specific limits are exceeded, a MEC results. MEC insurance holders may undergo tax obligations on distributions on an income-first basis, that is, to the degree there is gain in their plans, in addition to fines on any type of taxed quantity if they are not age 59 1/2 or older.

Please note that impressive fundings accumulate passion. Earnings tax-free treatment additionally thinks the car loan will become pleased from revenue tax-free death advantage profits. Loans and withdrawals minimize the plan's cash worth and fatality benefit, may cause certain plan advantages or riders to become inaccessible and may increase the opportunity the plan might gap.

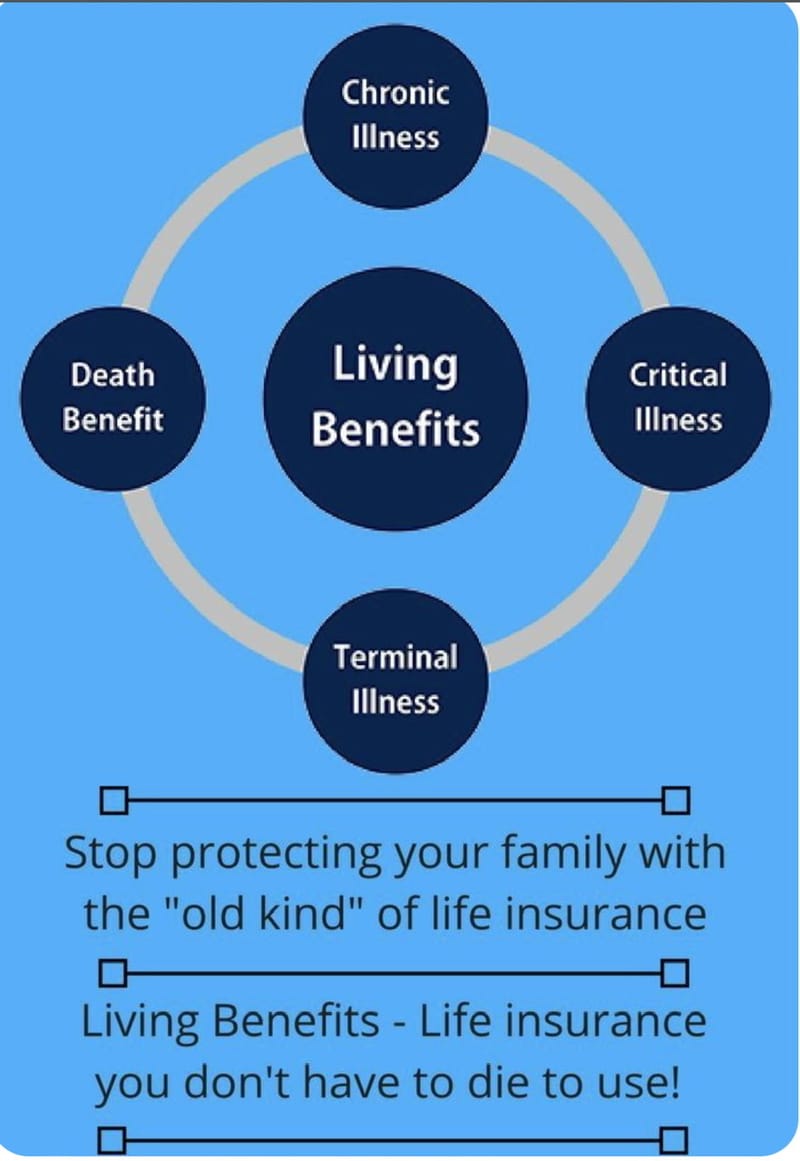

4 This is supplied through a Lasting Treatment Servicessm cyclist, which is offered for a service charge. In addition, there are constraints and restrictions. A client might certify for the life insurance policy, yet not the biker. It is paid as a velocity of the death advantage. A variable universal life insurance policy agreement is a contract with the key function of supplying a fatality advantage.

How much does Senior Protection cost?

These profiles are carefully taken care of in order to satisfy stated financial investment objectives. There are fees and fees connected with variable life insurance policy agreements, including death and threat costs, a front-end load, administrative fees, financial investment monitoring charges, abandonment charges and fees for optional motorcyclists. Equitable Financial and its affiliates do not offer legal or tax obligation guidance.

And that's excellent, since that's exactly what the death benefit is for.

What are the benefits of whole life insurance? Here are a few of the vital points you must recognize. One of one of the most enticing benefits of purchasing an entire life insurance policy policy is this: As long as you pay your costs, your death benefit will never run out. It is assured to be paid no matter when you die, whether that's tomorrow, in five years, 80 years or also better away. Retirement planning.

Assume you do not need life insurance policy if you don't have kids? You may wish to reconsider. It may appear like an unneeded cost. There are numerous benefits to having life insurance coverage, also if you're not supporting a household. Here are 5 reasons why you need to buy life insurance.

How can Income Protection protect my family?

Funeral costs, interment costs and clinical costs can add up. Long-term life insurance policy is readily available in various quantities, so you can select a fatality benefit that satisfies your demands.

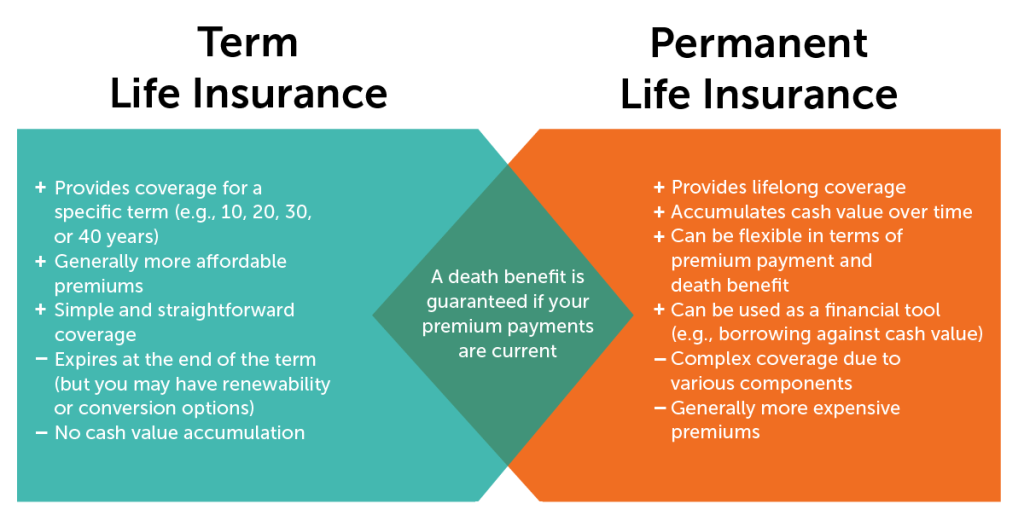

Establish whether term or permanent life insurance policy is ideal for you. As your individual situations adjustment (i.e., marriage, birth of a child or work promo), so will certainly your life insurance requires.

For the most component, there are 2 sorts of life insurance policy intends - either term or permanent plans or some mix of the two. Life insurance firms use various types of term strategies and typical life policies along with "passion sensitive" items which have actually come to be extra common given that the 1980's.

Term insurance policy offers defense for a specific period of time. This period can be as short as one year or provide protection for a specific variety of years such as 5, 10, two decades or to a specified age such as 80 or in many cases approximately the earliest age in the life insurance coverage mortality.

Can I get Term Life online?

Presently term insurance coverage rates are really affordable and among the cheapest traditionally experienced. It must be kept in mind that it is a commonly held idea that term insurance policy is the least costly pure life insurance coverage offered. One requires to evaluate the plan terms thoroughly to choose which term life alternatives are ideal to satisfy your particular conditions.

With each brand-new term the premium is increased. The right to restore the policy without evidence of insurability is a vital advantage to you. Or else, the danger you take is that your health and wellness may deteriorate and you might be not able to acquire a policy at the very same rates or perhaps in any way, leaving you and your beneficiaries without coverage.

You have to exercise this choice throughout the conversion duration. The length of the conversion duration will differ depending on the sort of term plan purchased. If you transform within the proposed duration, you are not needed to offer any type of info about your health. The premium price you pay on conversion is typically based on your "current achieved age", which is your age on the conversion date.

Under a level term plan the face quantity of the policy remains the exact same for the whole period. Usually such policies are sold as home mortgage defense with the quantity of insurance coverage reducing as the balance of the mortgage reduces.

How do I choose the right Term Life?

Typically, insurers have not had the right to change costs after the policy is offered. Considering that such policies may continue for several years, insurance providers must make use of conservative mortality, passion and expenditure rate quotes in the premium calculation. Flexible premium insurance coverage, nonetheless, allows insurance providers to offer insurance policy at lower "existing" premiums based upon much less conservative presumptions with the right to alter these costs in the future.

While term insurance coverage is developed to offer security for a defined amount of time, permanent insurance policy is made to provide protection for your entire life time. To maintain the premium price level, the costs at the younger ages goes beyond the real price of protection. This additional costs develops a get (money value) which assists pay for the plan in later years as the expense of security rises over the costs.

Under some plans, costs are called for to be paid for a set variety of years. Under other plans, costs are paid throughout the insurance policy holder's life time. The insurer spends the excess premium dollars This kind of policy, which is in some cases called cash worth life insurance policy, creates a savings aspect. Cash money values are vital to a permanent life insurance policy policy.

Latest Posts

Insurance For Funeral Costs

Burial Expense

Does Health Insurance Cover Funeral Costs