Featured

Table of Contents

- – What is 10-year Level Term Life Insurance? An ...

- – Why Consider Level Term Life Insurance Definit...

- – What Is Level Term Vs Decreasing Term Life In...

- – How Does 10-year Level Term Life Insurance Wo...

- – What is Term Life Insurance For Seniors and ...

- – What Exactly Does Level Benefit Term Life In...

If George is identified with a terminal ailment during the very first plan term, he probably will not be eligible to renew the plan when it ends. Some policies supply assured re-insurability (without proof of insurability), yet such features come with a greater expense. There are numerous kinds of term life insurance policy.

Most term life insurance policy has a level premium, and it's the type we have actually been referring to in many of this short article.

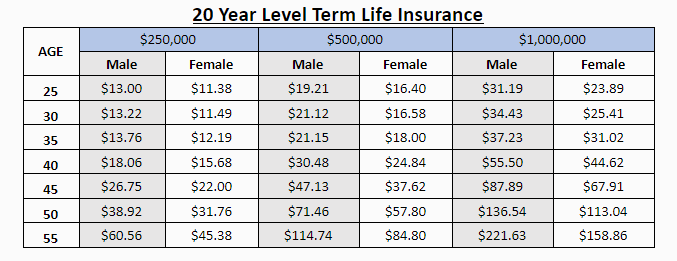

Term life insurance is appealing to young people with kids. Parents can acquire significant protection for an inexpensive, and if the insured passes away while the plan is in result, the family can rely on the fatality benefit to replace lost revenue. These plans are also well-suited for individuals with expanding family members.

What is 10-year Level Term Life Insurance? An Essential Overview?

Term life plans are ideal for people who desire significant insurance coverage at a low price. Individuals that possess whole life insurance policy pay extra in premiums for less coverage but have the safety and security of knowing they are protected for life.

The conversion rider should enable you to convert to any irreversible policy the insurer provides without limitations. The primary features of the cyclist are keeping the initial health and wellness score of the term plan upon conversion (also if you later on have health and wellness issues or end up being uninsurable) and making a decision when and just how much of the coverage to convert.

Of program, overall premiums will certainly boost substantially given that entire life insurance policy is extra pricey than term life insurance coverage. Clinical conditions that develop throughout the term life period can not trigger costs to be boosted.

Why Consider Level Term Life Insurance Definition?

Term life insurance policy is a fairly cost-effective way to provide a swelling sum to your dependents if something occurs to you. It can be a great alternative if you are young and healthy and sustain a family members. Whole life insurance features significantly higher month-to-month premiums. It is implied to give insurance coverage for as long as you live.

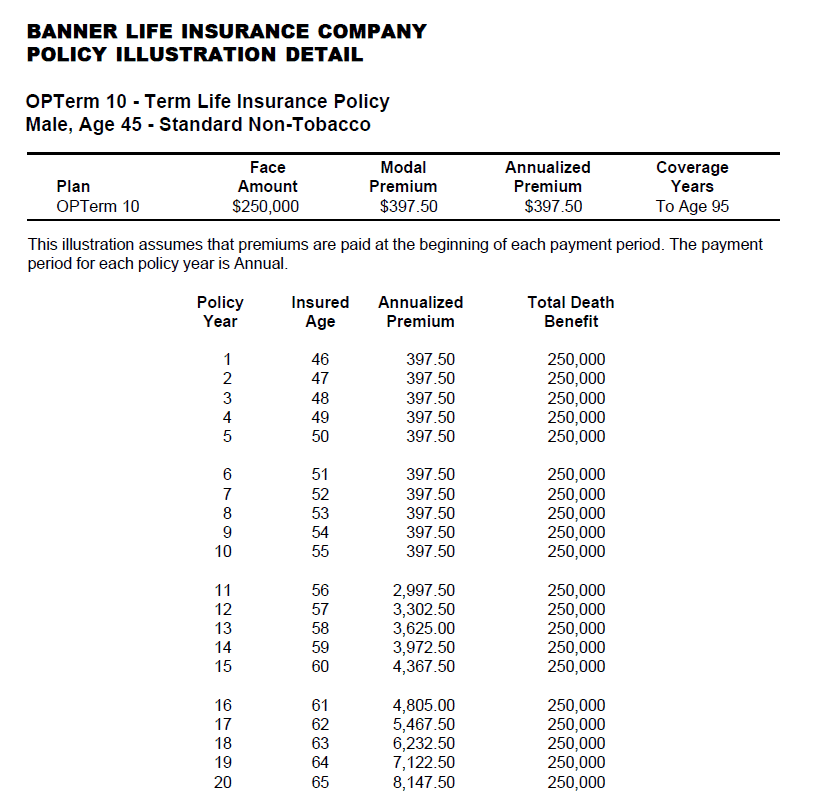

Insurance companies established a maximum age limit for term life insurance policies. The premium likewise climbs with age, so a person matured 60 or 70 will pay considerably even more than a person decades younger.

Term life is somewhat similar to vehicle insurance coverage. It's statistically not likely that you'll require it, and the premiums are cash down the tubes if you do not. If the worst occurs, your household will obtain the benefits.

What Is Level Term Vs Decreasing Term Life Insurance Coverage and How Does It Work?

Essentially, there are two types of life insurance coverage plans - either term or irreversible plans or some combination of the 2. Life insurers offer different forms of term strategies and traditional life plans as well as "passion delicate" products which have come to be extra prevalent since the 1980's.

Term insurance policy supplies security for a specified time period. This duration can be as short as one year or offer protection for a particular number of years such as 5, 10, twenty years or to a defined age such as 80 or in many cases approximately the earliest age in the life insurance policy mortality.

How Does 10-year Level Term Life Insurance Work?

Presently term insurance policy rates are very affordable and among the most affordable historically experienced. It must be noted that it is a commonly held belief that term insurance is the least expensive pure life insurance policy coverage offered. One requires to review the policy terms meticulously to choose which term life choices are suitable to meet your specific circumstances.

With each brand-new term the costs is boosted. The right to renew the policy without evidence of insurability is an essential benefit to you. Or else, the danger you take is that your health may wear away and you might be incapable to acquire a policy at the exact same prices or also whatsoever, leaving you and your recipients without protection.

The length of the conversion duration will vary depending on the type of term policy purchased. The premium price you pay on conversion is generally based on your "current attained age", which is your age on the conversion date.

Under a degree term plan the face quantity of the policy stays the same for the whole period. Typically such plans are sold as home loan security with the amount of insurance coverage reducing as the balance of the home loan reduces.

Generally, insurance companies have not can change costs after the policy is offered. Given that such plans might proceed for years, insurance companies need to use traditional mortality, passion and expenditure rate quotes in the costs calculation. Flexible premium insurance policy, however, permits insurers to provide insurance coverage at lower "current" costs based upon much less conventional assumptions with the right to alter these premiums in the future.

What is Term Life Insurance For Seniors and How Does It Work?

While term insurance is designed to supply security for a specified period, permanent insurance policy is designed to offer protection for your entire lifetime. To keep the premium price degree, the premium at the more youthful ages goes beyond the actual expense of security. This additional costs constructs a reserve (cash worth) which aids spend for the plan in later years as the expense of protection surges above the costs.

Under some plans, costs are needed to be paid for a set variety of years (What does level term life insurance mean). Under other policies, costs are paid throughout the policyholder's lifetime. The insurance policy firm spends the excess premium dollars This kind of policy, which is in some cases called cash money value life insurance policy, produces a cost savings component. Cash money worths are essential to a long-term life insurance coverage plan.

In some cases, there is no correlation between the size of the cash money value and the premiums paid. It is the cash value of the policy that can be accessed while the insurance holder lives. The Commissioners 1980 Criterion Ordinary Mortality (CSO) is the current table used in computing minimal nonforfeiture worths and plan reserves for common life insurance coverage policies.

What Exactly Does Level Benefit Term Life Insurance Offer?

Numerous permanent plans will certainly have stipulations, which specify these tax requirements. Standard whole life plans are based upon lasting quotes of expenditure, passion and mortality.

Table of Contents

- – What is 10-year Level Term Life Insurance? An ...

- – Why Consider Level Term Life Insurance Definit...

- – What Is Level Term Vs Decreasing Term Life In...

- – How Does 10-year Level Term Life Insurance Wo...

- – What is Term Life Insurance For Seniors and ...

- – What Exactly Does Level Benefit Term Life In...

Latest Posts

Insurance For Funeral Costs

Burial Expense

Does Health Insurance Cover Funeral Costs

More

Latest Posts

Insurance For Funeral Costs

Burial Expense

Does Health Insurance Cover Funeral Costs